Discover the very best 21 metal producing companies during the US, specializing in precision machining, fabrication, and reducing applications. Find out how PCC Structurals and Kennametal are foremost the marketplace.

From volatility and geopolitics to economic developments and investment outlooks, remain educated on The main element developments shaping today's markets.

But here's the place your risk tolerance becomes an element. Despite your time horizon, it is best to only take on a amount of risk with which you might be comfortable. So Even when you're conserving for a protracted-expression intention, in case you are much more risk-averse you might want to look at a more well balanced portfolio with some preset income investments.

The more you allocate to stocks, the upper your portfolio's predicted risk/reward. The more you allocate to bonds, the lower your portfolio's expected risk/reward.

Morgan Stanley helps folks, institutions and governments increase, handle and distribute the money they should achieve their ambitions.

Get personalised matches depending on your special problem in just a few minutes. Hook up with advisors with many years of knowledge who offer a wide array of wealth management services.

A down market gives chances to check development towards your long-term investing plans—and perhaps help save on taxes.

On page twenty of his 2013 letter to Berkshire Hathaway shareholders, Warren Buffett outlined The easy investment technique he established out in his will for his spouse's rely on.

The investment strategies mentioned right here may not be appropriate for everyone. Every Trader really should overview an investment technique for their own individual specific predicament before making any investment final decision.

Considering the fact that our founding in 1935, Morgan Stanley has regularly sent initially-course small business in a primary-class way. Underpinning everything we do are 5 core values.

Diversification allows traders never to "put all in their eggs in one basket." The theory is the fact if one stock, sector, or asset course slumps, Other individuals may well rise.

The 1st is the number of many years till you hope to want the money—generally known as your time and effort horizon. The next is your risk tolerance.

Simply because managed products put money into baskets of securities, they're by now reducing "per situation" risk for yourself.

Diversification is a strategy of spreading investments across a variety of assets to cut back risk. In this way, if a single investment performs badly, Some others Investment allocation experts may possibly compensate.

Loni Anderson Then & Now!

Loni Anderson Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Soleil Moon Frye Then & Now!

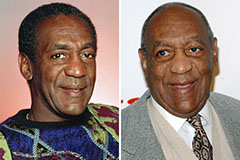

Soleil Moon Frye Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!