For the previous seven yrs, Kat continues to be helping persons make the most effective fiscal decisions for his or her unique circumstances, whether or not they're on the lookout for the ideal insurance plan policies or trying to shell out down credit card debt. Kat has abilities in insurance and university student financial loans...

Physical precious metals: You can buy physical bars, coins, and jewellery comprised of precious metals to hold as an investment. These physical precious metallic investments really should obtain worth as the price of the fundamental precious metal raises.

Unique Retirement Preparations: Self-Managed vs. Self-Directed In all IRAs, account owners can Choose between investment options authorized from the IRA rely on settlement and might get and provide All those investments in the account operator's discretion, so long as the sale proceeds stay within the account.

We consider our best asset is our people. We price our determination to diverse perspectives and also a culture of inclusion over the agency. Learn who we're and the ideal chance for yourself.

We’re going to shoot it for you straight: You almost certainly don’t really need a self-directed IRA to take a position for retirement. Pretty much 100 p.c of time, most individuals are superior off sticking with an everyday IRA (once more, Roth is very best!

It brings together the pace and relieve of pace of contemporary brokers like copyright and Webull Together with the status, stability, and security of brokers like Fidelity and TD Ameritrade.

Precious metals are internet uncommon metals which have superior financial worth. They're valuable given that they're scarce, valuable for industrial processes, or have investment Attributes which make them a great shop of worth.

Being an investment, precious metals will often be sought after to diversify portfolios and for a retailer of price, specially for a hedge in opposition to inflation And through periods of financial uncertainty.

it goes into the account so which the investments expand tax-free of charge and the money you are taking out from your account at retirement received’t be taxed in the least. In the event you

are classified as the a person in control of finding and controlling the investments you've inside your account. That’s why you always won’t find self-directed IRAs made available at most standard brokerage corporations and banking institutions that provide regular IRAs. Rather, you can find investment corporations on the market that specialise in self-directed IRAs and could act as a custodian for your account.

1. They feature higher fees and complex recordkeeping. Since the investments within a self-directed IRA are more complicated than more traditional investments, most organizations which provide them will cost bigger-than-common routine maintenance service fees that might take a Chunk out of one's earnings. Not forgetting that it could choose lots of operate to maintain documents and sustain with many of the tax reporting prerequisites. two. They have a great deal of rules and recommendations to abide by. Not simply that, but there are also prohibited transactions set through the IRS that you've got to concentrate on.

At Morgan Stanley, you’ll obtain trustworthy colleagues, dedicated mentors and a culture that values diverse perspectives, unique intellect and cross-collaboration. See how you can keep on your profession journey at Morgan Stanley.

the IRA until finally you’re fifty nine 1/2 years aged (Except if you wish to get strike with taxes and early withdrawal penalties). And we recommend that you just only buy a rental residence When you've got the income available to order it—no exceptions! But even if you

Among the list of points of interest of gold and silver is the two might be obtained in this hyperlink a number of investment kinds:

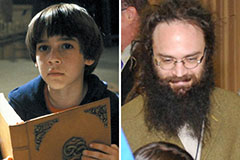

Edward Furlong Then & Now!

Edward Furlong Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!